south dakota vehicle sales tax exemption

- All sales of vehicles by auction are subject to either sales or use tax or motor vehicle excise tax unless exempt under. The Motor Vehicle Division provides and maintains your motor vehicle records.

In the state of South Dakota sales tax is legally required to be collected from all tangible physical products being sold to a consumer.

. This form is to be used when claiming an exemption from the South Dakota excise tax on a South Dakota titled vehicleboat. In South Dakota the taxable price of your new vehicle will be considered to be 5000 as the value of your trade-in is not subject to sales tax. What Rates may Municipalities Impose.

The South Dakota sales tax and use tax rates are 45. However the buyer will have to. Our online services allow you to.

Relief agencies and religious and private schools must apply to the department and. You will need to present this certificate to the vendor from whom you are making the exempt purchase - it is up to the vendor to verify that you are indeed qualified to make a tax-exempt. Employee Purchases - The exemption from sales and use tax for the above agencies does not extend to the purchase of products or.

Several examples of items that. When Sales Tax Is Exempt in South Dakota South Dakota offers exemption from car sales tax in multiple different situations including. Certain disabled veterans may be eligible for a sales and use tax exemption on the purchase of a vehicle owned and used primarily by or for the qualifying veteran.

In the state of south dakota sales tax is legally required to be collected from all tangible physical products being sold to a consumer. This means that you save the sales taxes you. South Dakotas taxes on vehicle purchases are applied to the sale price before rebates or incentives.

SDCL 10-45-10 exempts from sales tax the sale of products and services to the following governmental entities. Are NOT exempt from South Dakota sales or use tax. Sales Tax Exemptions in South Dakota In South Dakota certain items may be exempt from the sales tax to all consumers not just tax-exempt purchasers.

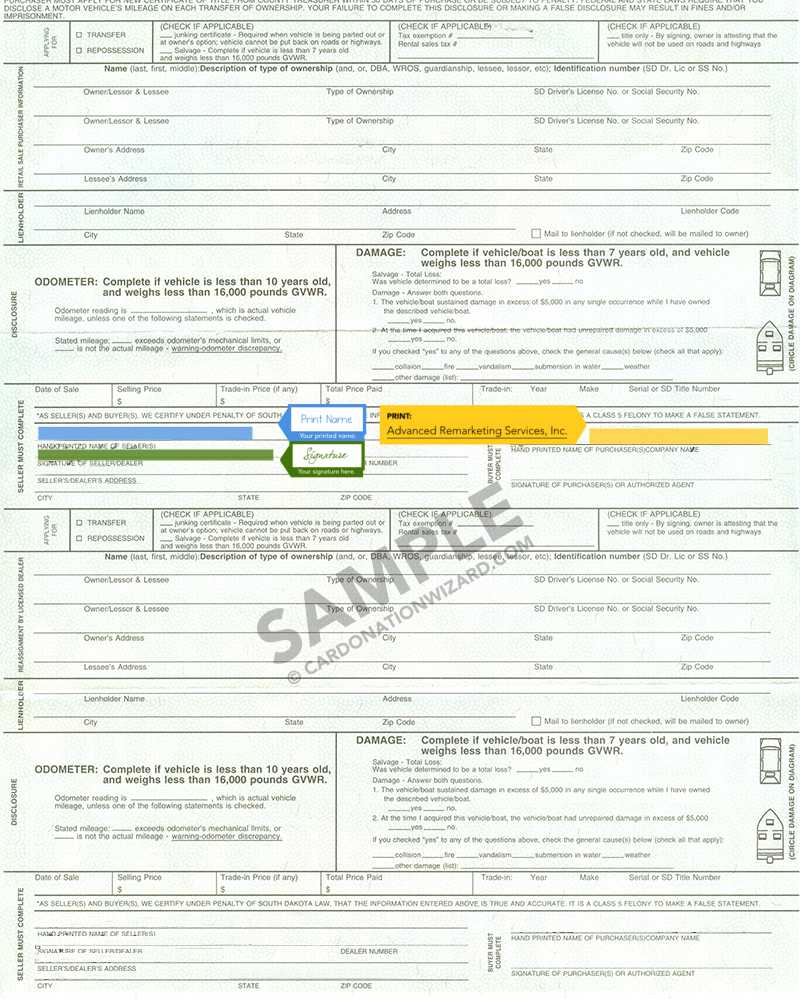

Vehicles acquired by inheritance Vehicles transferred between spouses between. All sales of vehicles by auction are subject to either sales or use tax or motor vehicle excise tax unless exempt under SDCL 32-5B-2. South Dakota Title Number _____ Odometer Reading is_____which is.

South Dakota offers a lot of exemptions to its vehicle sales tax. The vehicle is exempt from motor vehicle excise tax under. Several examples of of items that exempt from South.

The state also has several special taxes and local jurisdiction taxes at the city and county levels including lodging taxes alcohol taxes. Any motor vehicle sold or transferred. Thus a 12000 car may have a 1200 cash rebate.

South Dakota Vehicle Sales Tax Exemption. The vehicle is exempt from motor vehicle excise tax under. South Dakotas sales and use tax rate is 45 percent.

State law exempts certain entities from paying South Dakota sales tax or use tax on their purchases. Indian Tribes United States government agencies State of South Dakota. South Dakota municipalities may impose a municipal sales tax use tax and gross receipts tax.

Review and renew your vehicle registrationdecals and license plates. Vehicle Identification Number VIN To be exempt from South Dakotas motor vehicle excise tax imposed by SDCL 32-5B-1 at the time the vehicle is purchased the applicant must.

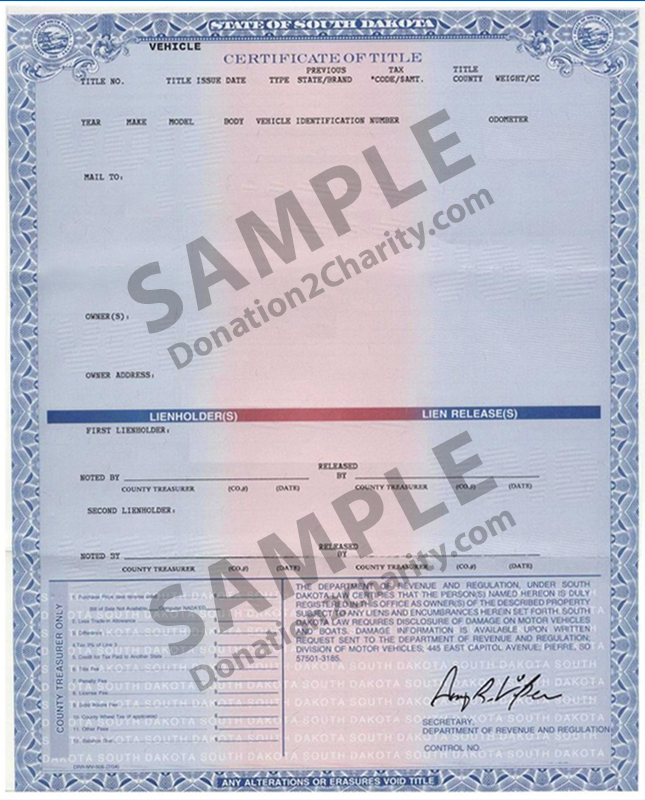

Form Mv 608 Fillable State Of South Dakota Application For Motor Vehicle Title And Registration

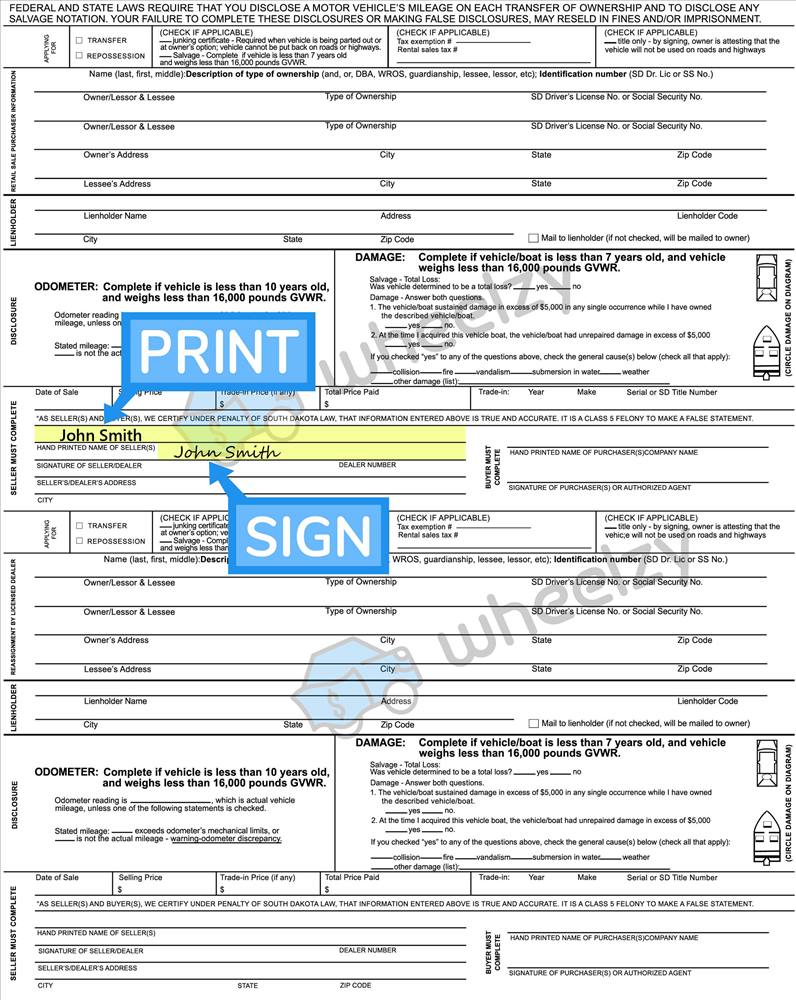

How To Sign Your Car Title In South Dakota Including Dmv Title Sample Picture

South Dakota Sales Tax Guide For Businesses

Form Rv 093 Fillable Sales Tax Exempt Status Application

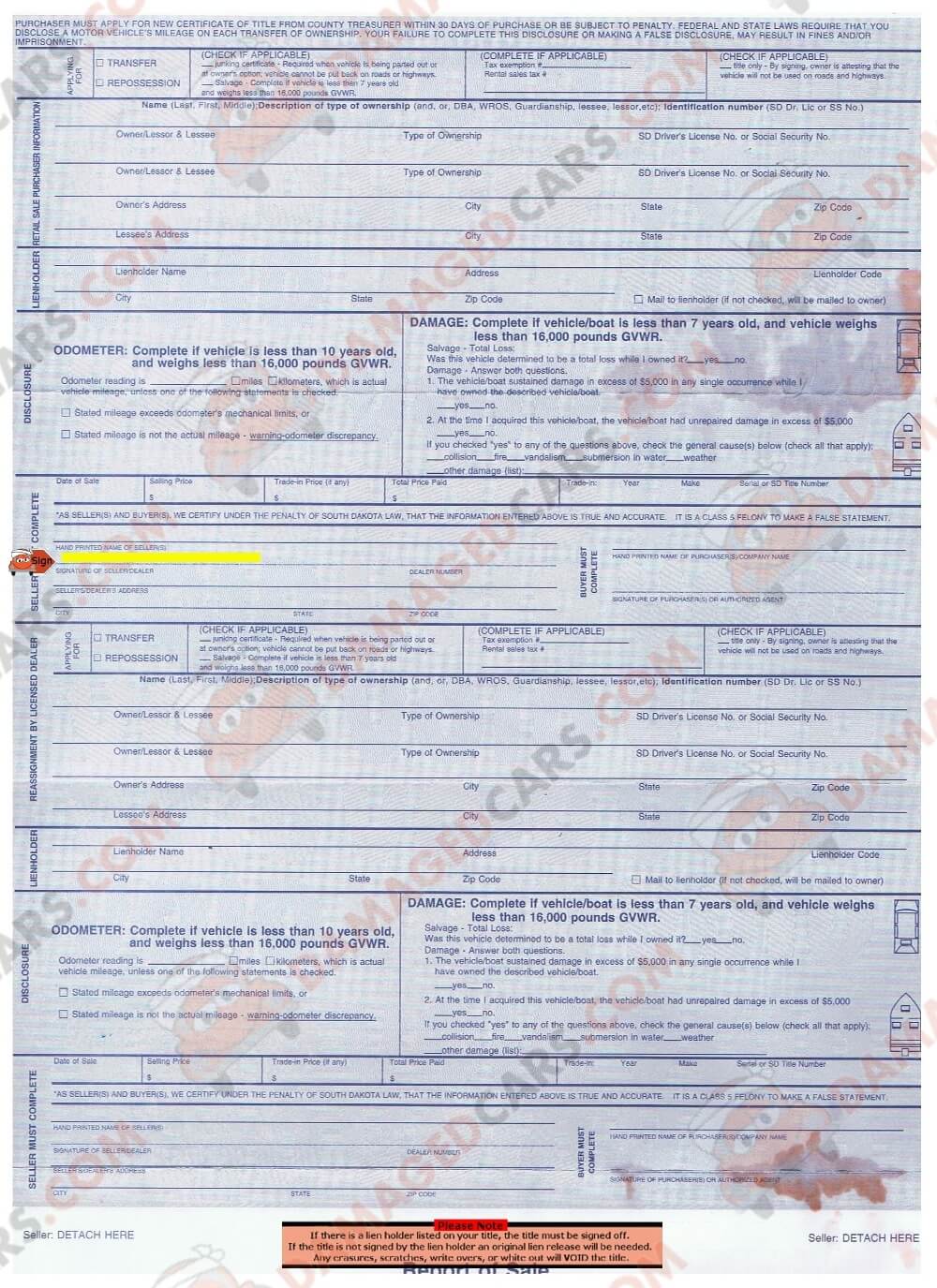

South Dakota Car Title How To Transfer A Vehicle Rebuilt Or Lost Titles

Car Donation South Dakota Support Sd Charities Car Donation Wizard Car Donation Wizard

South Dakota Car Title How To Transfer A Vehicle Rebuilt Or Lost Titles

Vehicle Registration For Military Families Military Com

South Dakota Vehicle Sales Tax Fees Calculator Find The Best Car Price

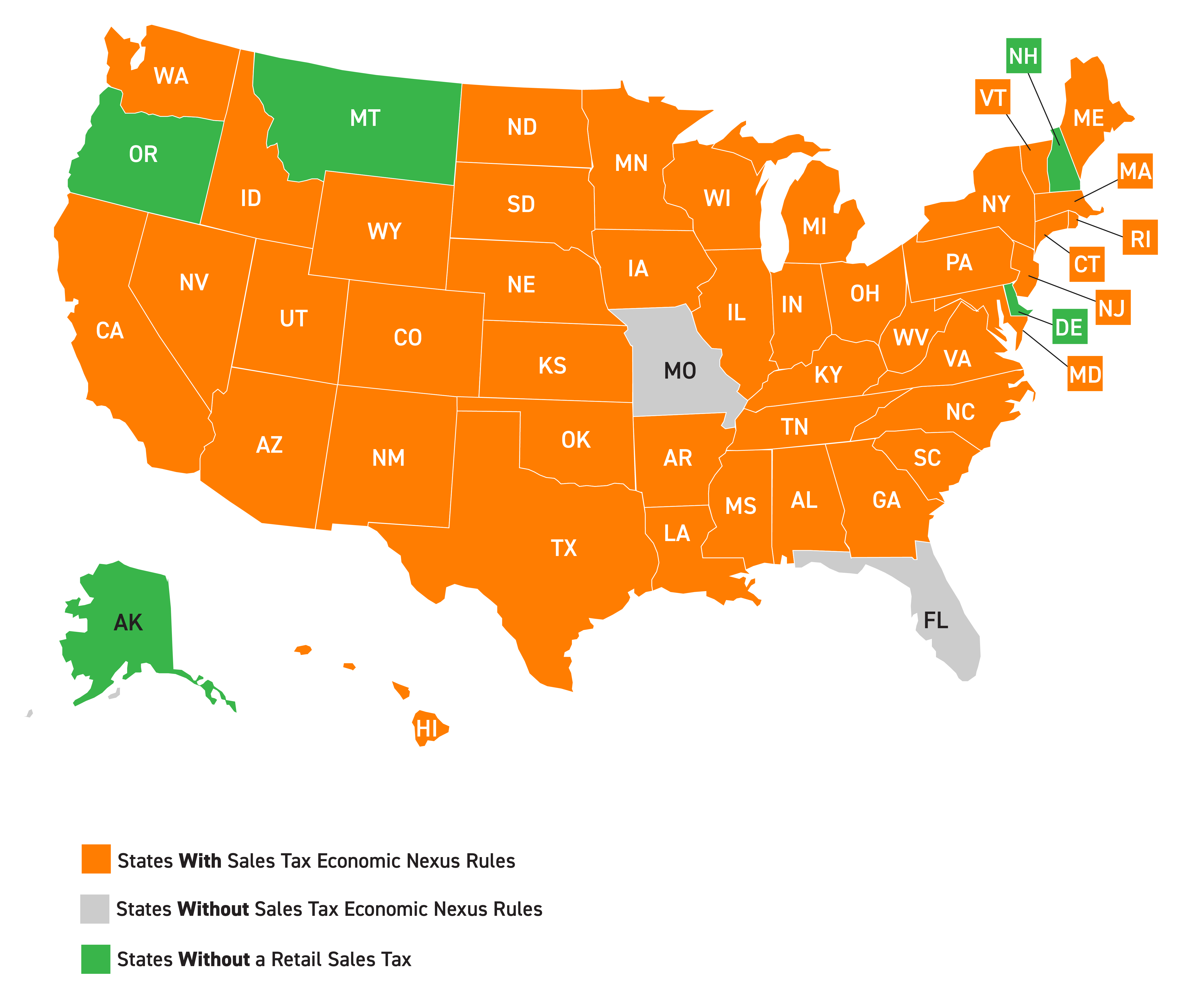

Out Of State Sales Tax Compliance Is A New Fact Of Life For Small Businesses

Car Tax By State Usa Manual Car Sales Tax Calculator

State And Local Sales Tax Rates Midyear 2021 Tax Foundation

How To Get A Sales Tax Exemption Certificate In Iowa Startingyourbusiness Com

Sales Taxes In The United States Wikipedia

State Local Sales Tax Rates 2020 Sales Tax Rates Tax Foundation

How To Save Money With A Sales Tax Exemption For Home Medical Equipment Accessible Systems